Bitcoin Hardware Wallets

Welcome back, I’m Kathleen Bitcoin. I’m 20 years old, new to the bitcoin world, and here to write on the current hot topics in bitcoin while I learn about it along the way.

Last week I talked about how I came into the bitcoin world. This week I’m talking about hardware wallets. Why? Because now that I’ve started actually obtaining bitcoin since learning about it, it’s spread out between CashApp and Swan, and I need somewhere to store it.

In a previous post, I mentioned protecting your bitcoin with a hardware wallet. This is important for everyone who’s accumulated bitcoin, new and old. A hardware wallet allows you to transfer your bitcoin from one place to another, send and receive bitcoin, and pay with it; all by plugging it right into your computer. Your bitcoin can trade straight from your wallet rather than being deposited to an exchange wallet. That saves you time by skipping deposit delays and fees from withdrawal limits.

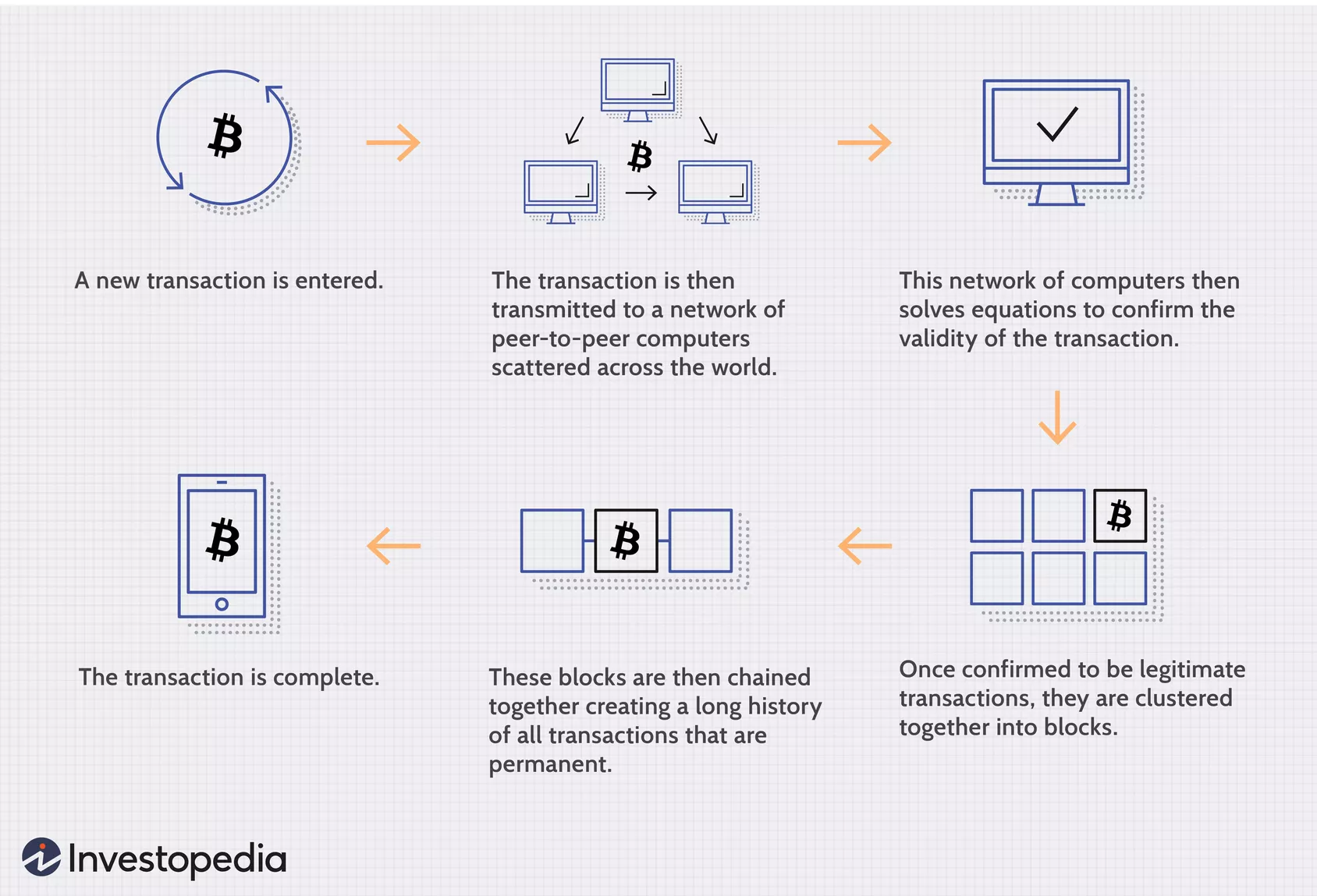

To make it a bit confusing, the bitcoin itself isn’t stored on the wallet, it’s always stored on the blockchain (see previous post “Bitcoin Blockchain”). The hardware wallet just stores your private key (see previous post “Beginners Guide to Bitcoin”). That private key opens the lock to your address on the blockchain where your bitcoin actually lives. Since the blockchain is everywhere, all you need is your hardware wallet to interact with your bitcoin.

Hardware wallets are super secure, too. They keep your bitcoin safe even when the computer you’re using isn’t secure. They give you added protection against scammers, phishing sites, and malware. It does this by isolating your private key from the internet so you can be protected from an online attack. Another pro to owning a hardware wallet is that when you create a blockchain transaction (by purchasing, selling, or receiving bitcoin), you’re “signing” a special message. Your “signature” proves the ownership of your private key. It’s impossible to forge this signature without your key, so no one else can make a transaction for you without it. Software wallets do the same thing.

Your private keys stored on the hardware wallet are protected by a PIN and a passphrase, which is optional but highly suggested. If someone were to steal your hardware wallet, it’s almost impossible for them to take your keys. The keys are never exposed to the internet so they can’t be stolen. That’s why it’s known as cold storage.

If you lose your wallet, your bitcoin is backed up with a seed phrase. A seed phrase, also known as a recovery phrase, is a list of words that re-generate your private key. You can use your seed phrase to move your keys to a different hardware wallet.

But what if your wallet gets destroyed? You lose your bitcoin and your seed words. You can’t always protect it from getting destroyed, just like my Dad couldn’t stop our dog from eating his. So what do you do? You buy a CypherWheel to protect your seed words! The CypherWheel is a unique way to store your seed words or other sensitive information. Machined from 5/16″ thick 303 Stainless Steel, not stamped out from thin 1/16″ metal. Protects your seed words from physical disaster and bad dogs! With an added level of locking protection, this bitcoin wallet keeps your confidential information safe from prying eyes.

Here are a few wallets to check out if you’re interested: Passport, Trezor, Ledger, Cold Card.

If you want to start Dollar Cost Averaging your way into buying bitcoin, use our link and start your plan today to get $10 of free bitcoin dropped into your account: https://www.swanbitcoin.com/CypherSafe/!

And don’t forget to protect it with a CypherWheel!

Thanks again,

Kathleen Bitcoin

Twitter: @KathleenBitcoin